8 Photos Present Value Of Ordinary Annuity Due Table And View Alqu Blog

Net Present Value Analysis with Multiple Investments. A project requiring an investment of $20,000 today and $10,000 one year from today, will result in cash savings of $4,000 per year for 15 years. Find the net present value of this investment using a rate of 10 percent. Round to the nearest dollar. Net Present Value Calculation with Taxes.

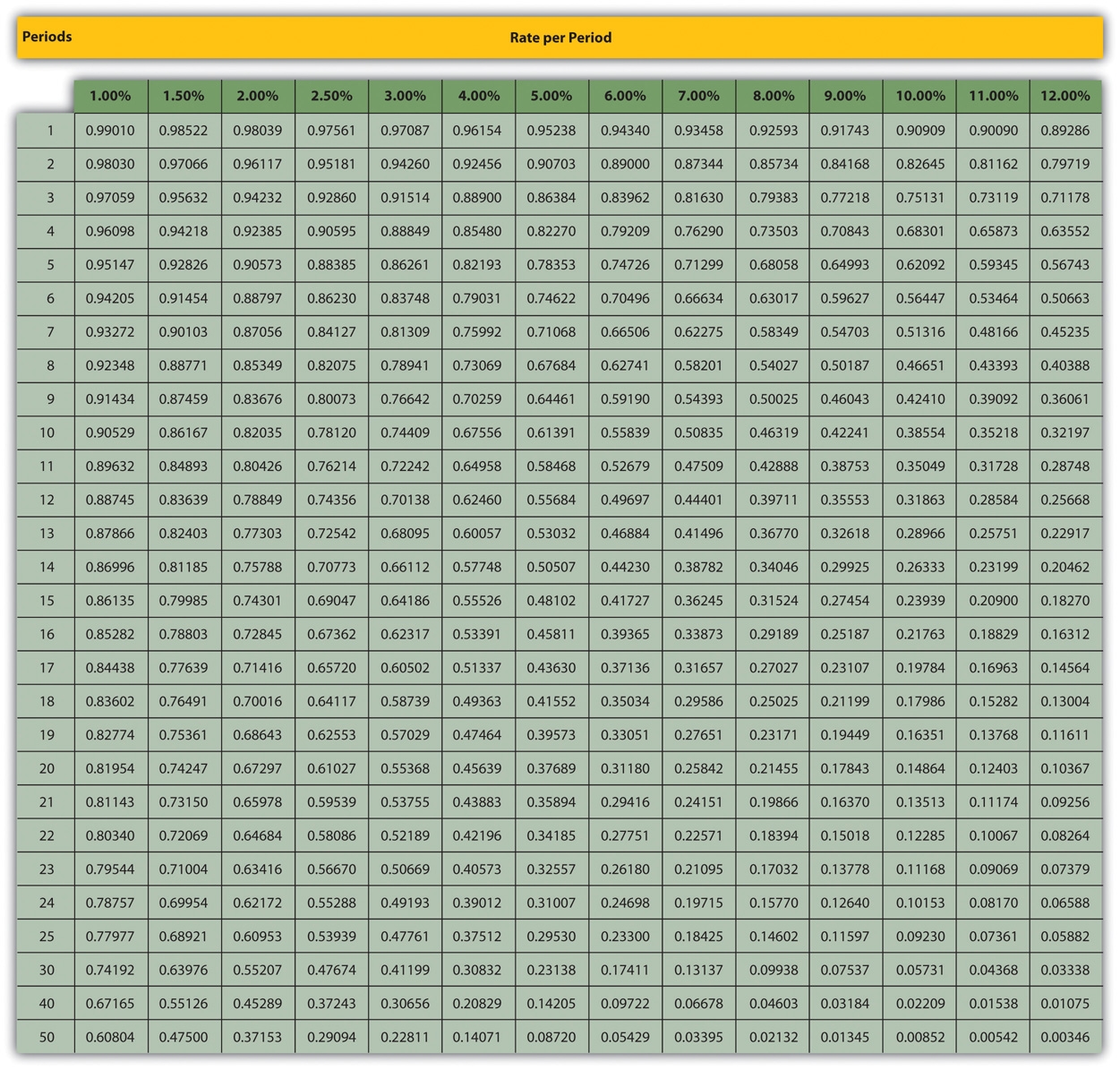

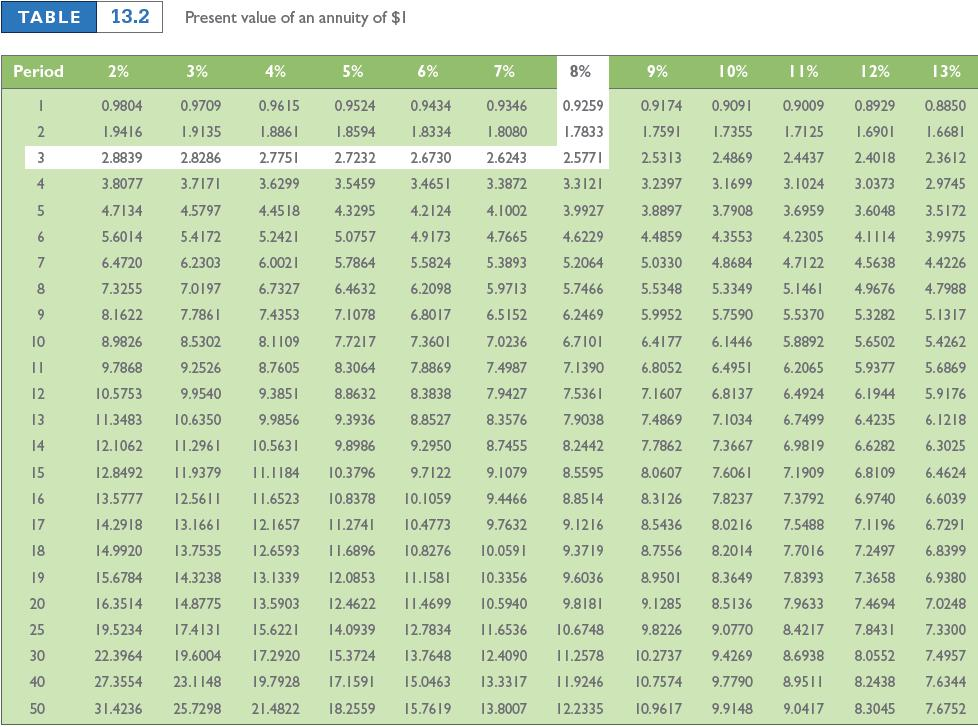

Solved TABLE 13.2 Present value of an annuity of I Period

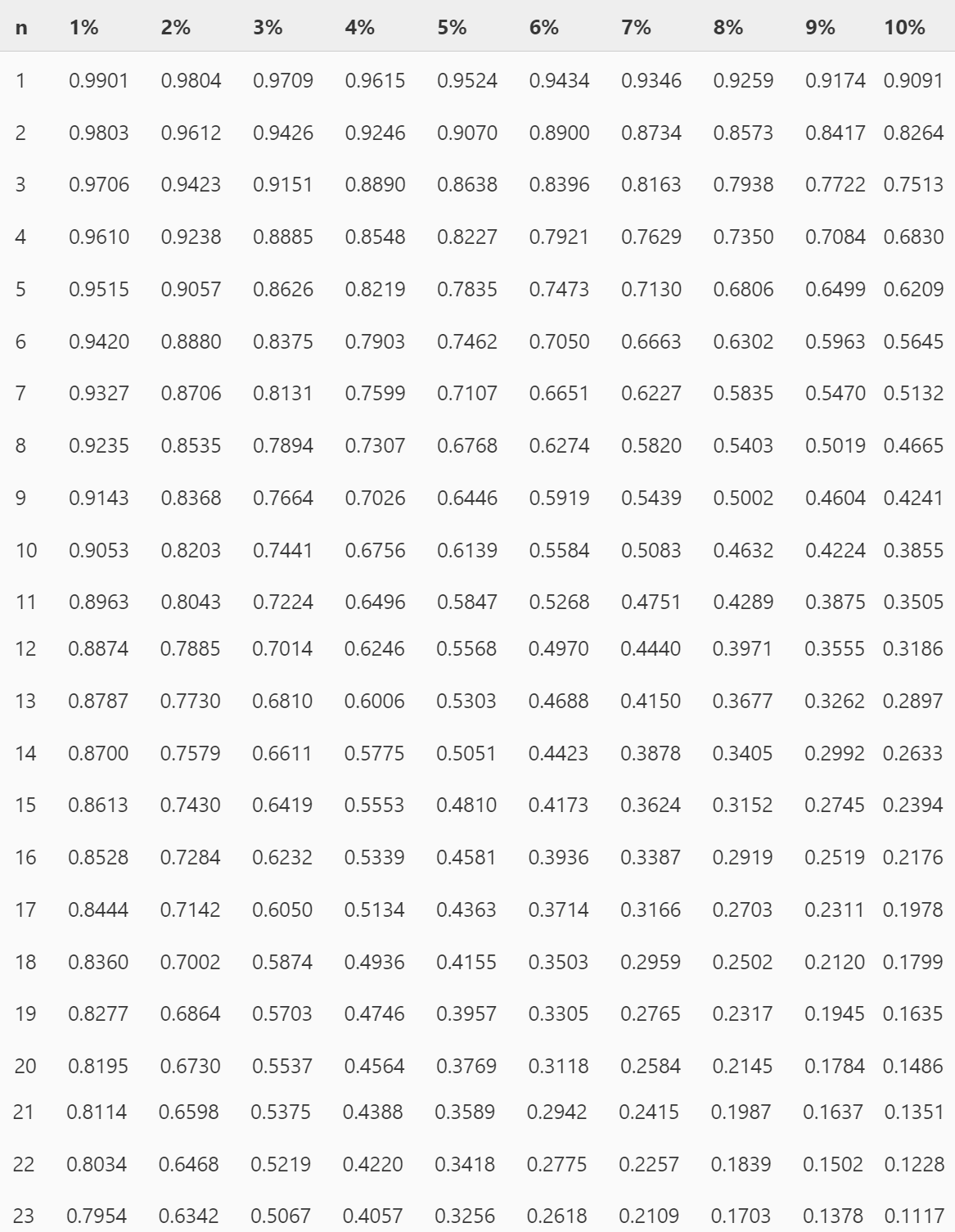

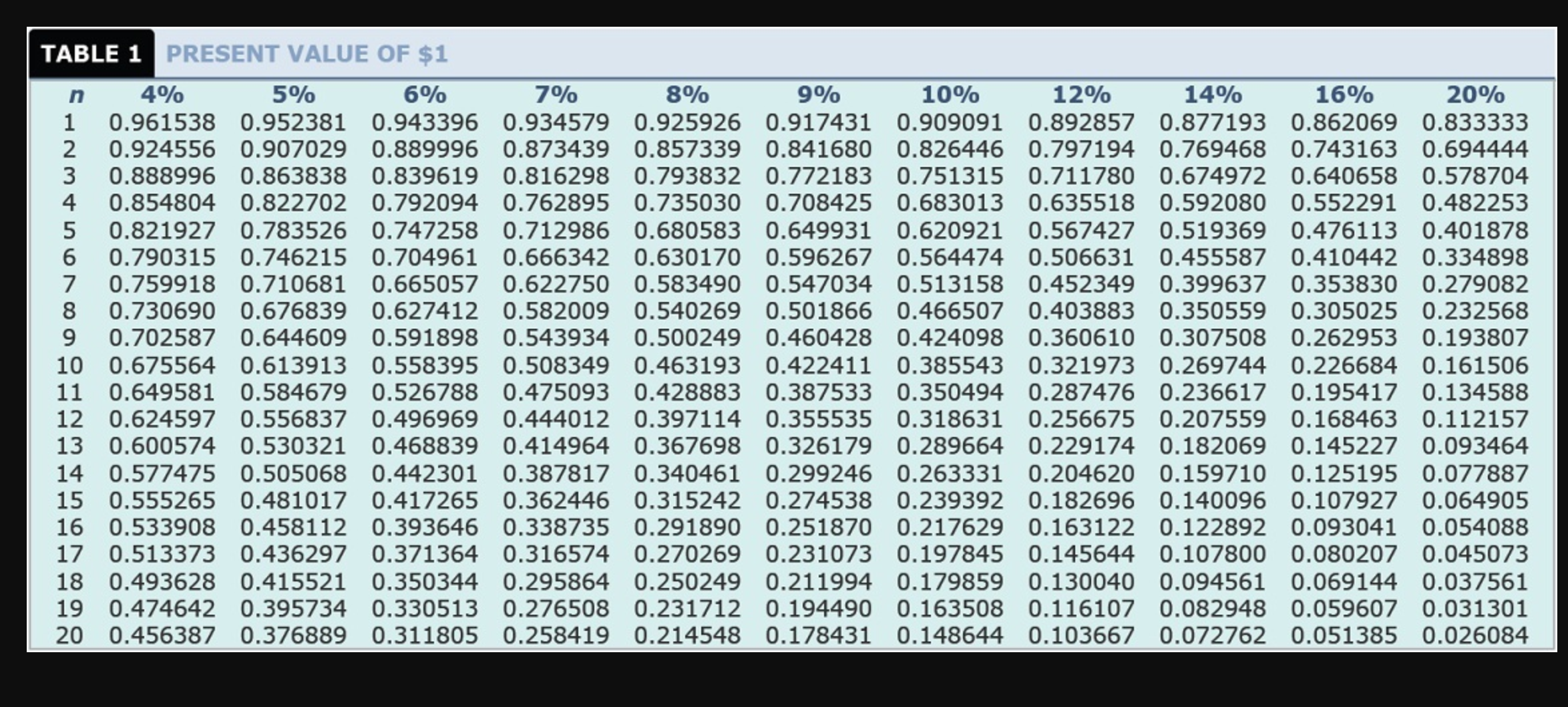

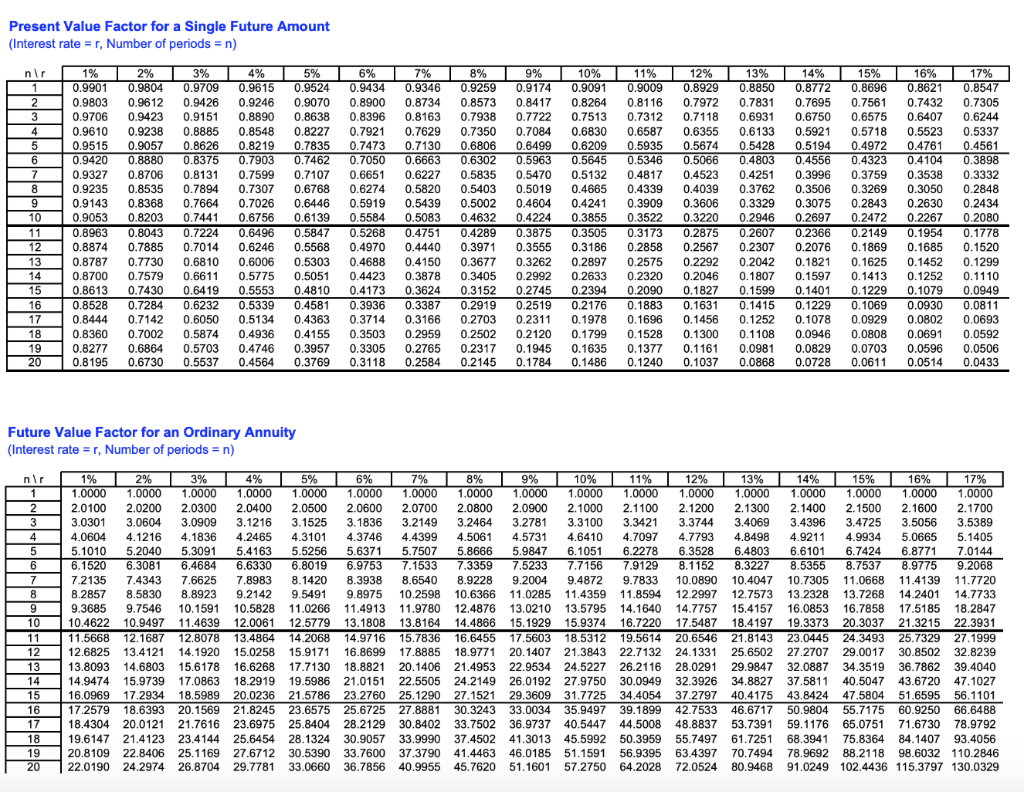

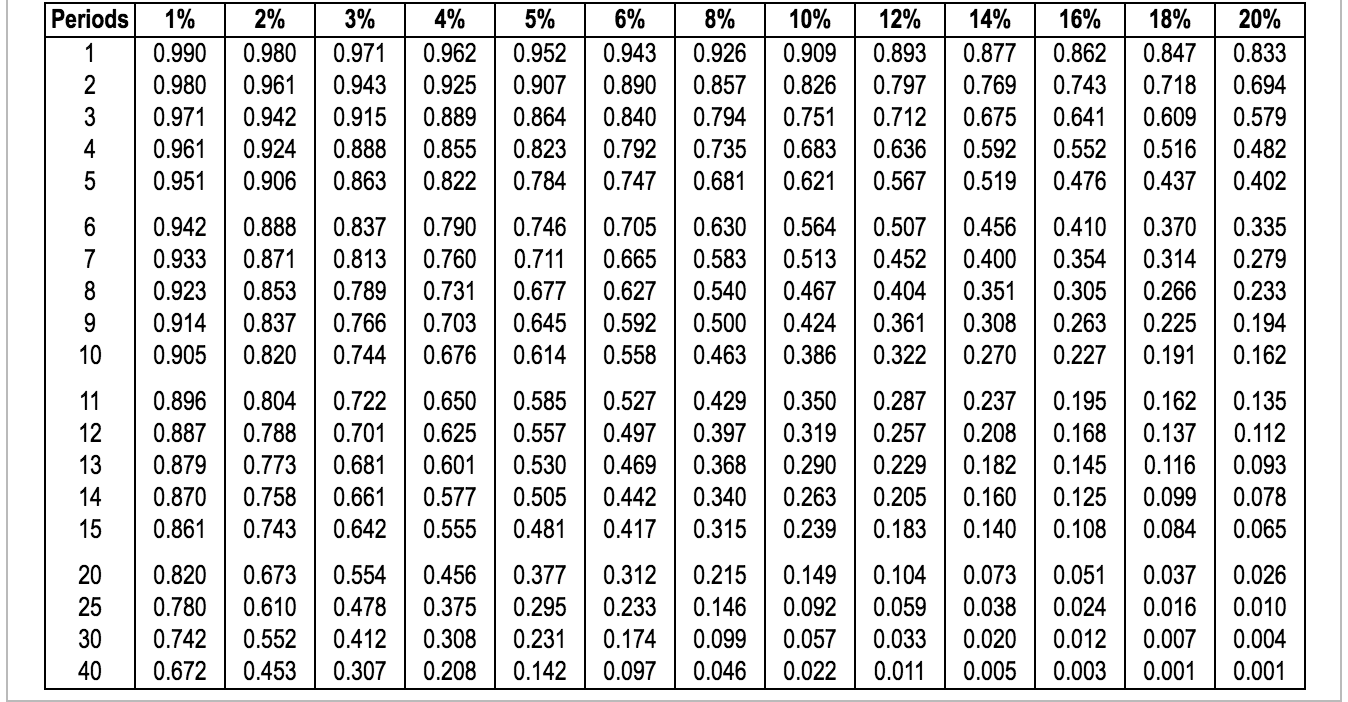

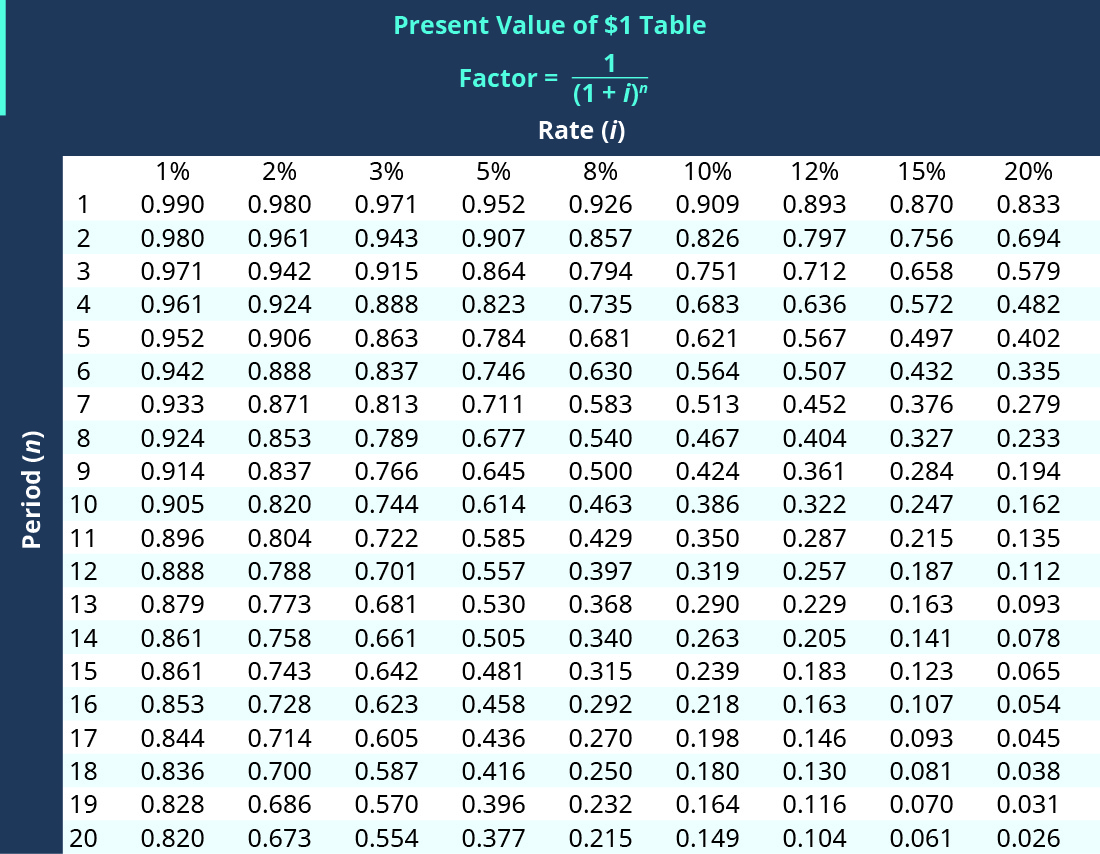

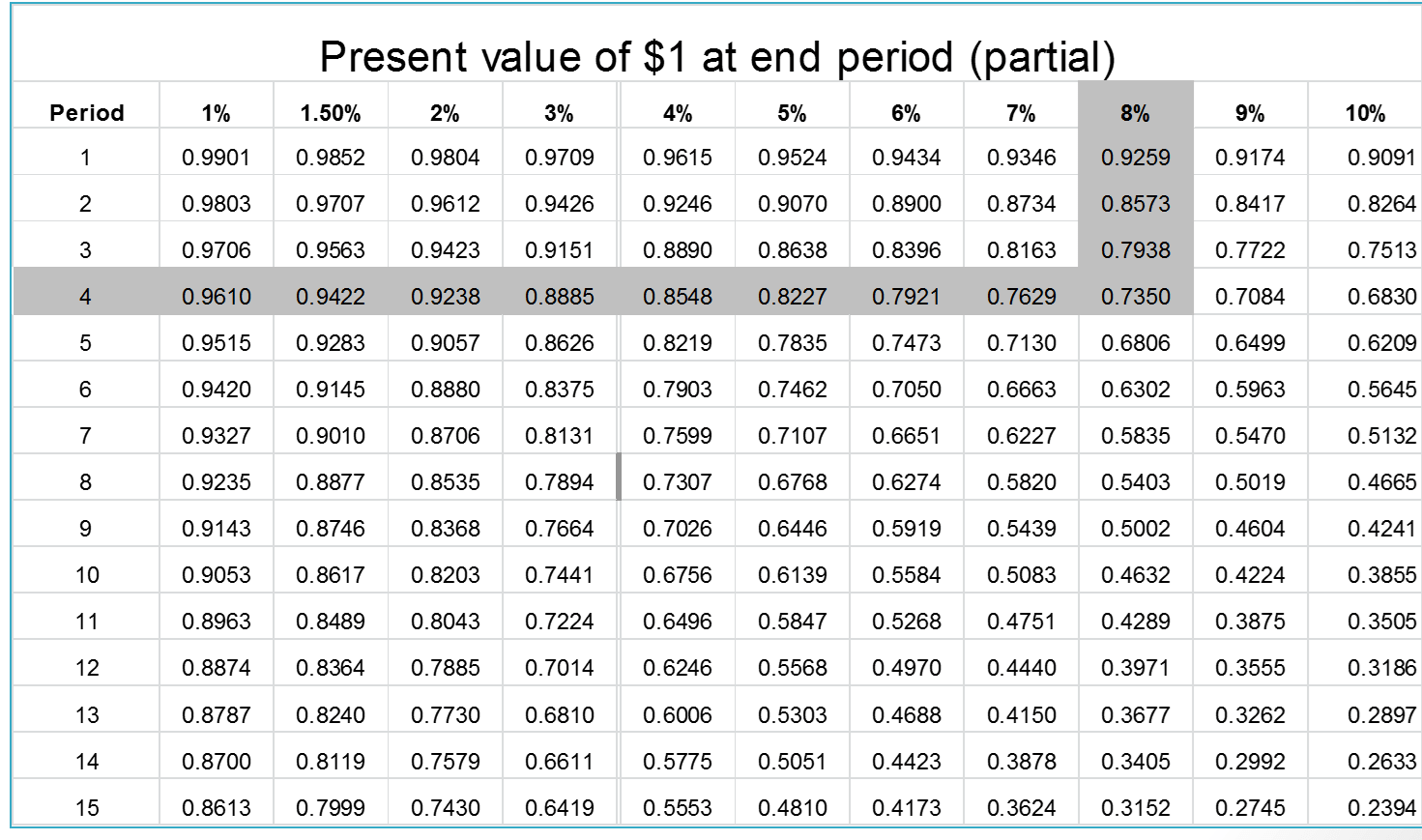

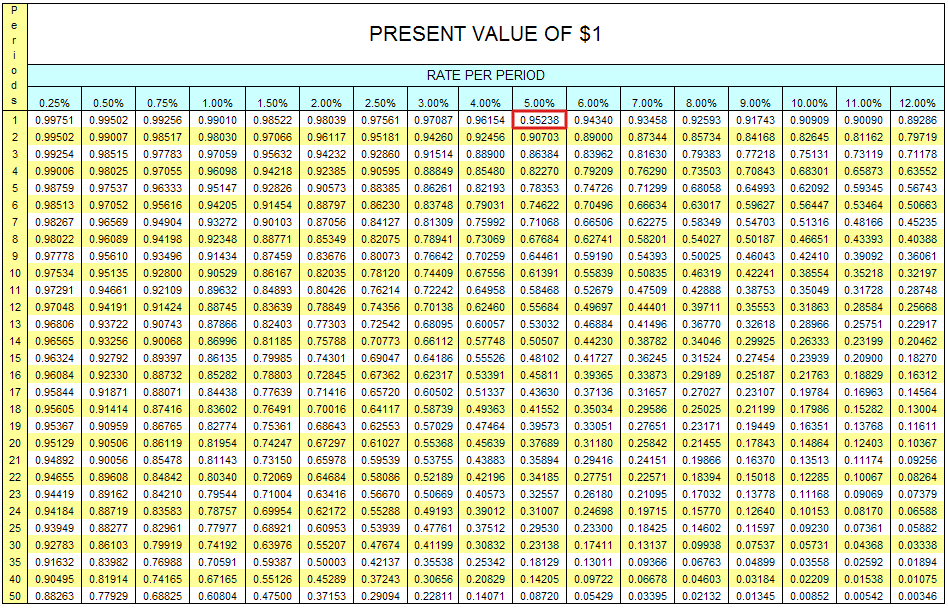

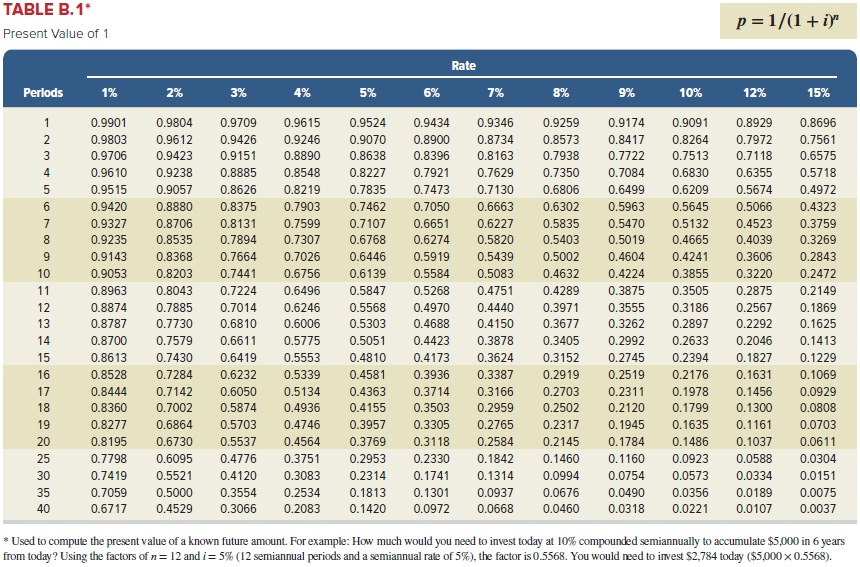

The purpose of the present value tables is to make it possible to carry out present value calculations without the use of a financial calculator. They provide the value now of 1 received at the end of period n at a discount rate of i%. The present value formula is: PV = FV / (1 + i) n This can be re written as: PV = FV x 1 / (1 + i)n

Present Value of 1 Table PVIF Printable and Excel Template

Answer: Print Table Present Value of $1 ( PVIF) PV = $1 (1 + i)n P V = $ 1 ( 1 + i) n n / i 5.000% 5.125% 5.250% 5 0.78353 0.77888 0.77426 6 0.74622 0.74091 0.73564 7 0.71068 0.70479 0.69895

Answered TABLE 1 PRESENT VALUE OF 1 8 4 5 6… bartleby

Table of Present Value Annuity Factor Number of periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091

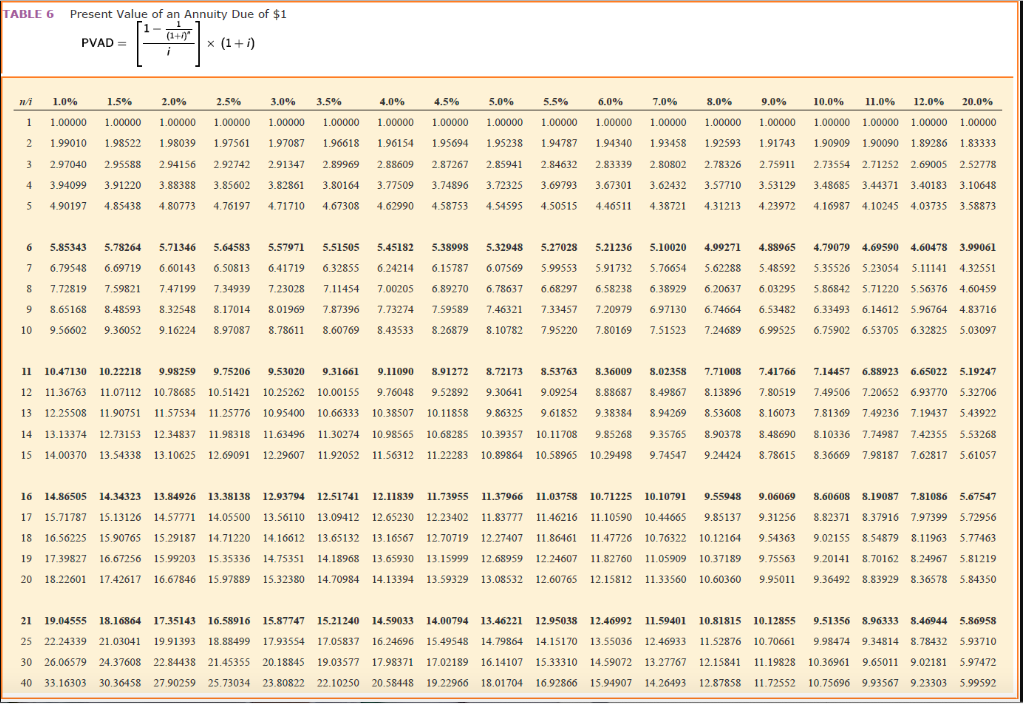

Solved TABLE 6 Present Value of an Annuity Due of 1 (1+0" х

Present value (PV) is the current value of a future sum of money or stream of cash flows given a specified rate of return. Future cash flows are discounted at the discount rate, and the higher.

Solved TABLE 4 Present Value of an Ordinary Annuity of 1 1

TABLE AI.3 Present Value of $1 Interest Rate 508. TABLE AI.4 Present Value of an Annuity of $1 Interest Rate 509. Title: Appendix I: Future and Present Value Tables Created Date:

Net present value (19,097) Sweeney Industries

Present value is what cash flow received in the future is worth today at a rate of interest called the "discount" rate. Here's an easy way to look at present value. If you invest $1,000 in a savings account today at a 2% annual interest rate, it will be worth $1,020 at the end of one year ($1,000 x 1.02). Therefore, $1,000 is the present.

Present and Future Value Tables SPSCC — ACCT&202 working

Present value is the current value of an asset to be received in the future or the amount that would need to be invested today to receive a specific amount in the future. It accounts for the.

PVTable

Present value formula To calculate the present value of future incomes, you should use this equation: PV = FV / (1 + r) where: PV - Present value; FV - Future value; and r - Interest rate. Thanks to this formula, you can estimate the present value of an income that will be received in one year.

Solved TABLE 2 Present Value of 1 PV = n/i 1.0 1.5 2.0

Calculation Using a PV of 1 Table The present value of receiving $5,000 at the end of three years when the interest rate is compounded quarterly, requires that (n) and (i) be stated in quarters. Use the PV of 1 Table to find the (rounded) present value figure at the intersection of n = 12 (3 years x 4 quarters) and i = 2% (8% per year ÷ 4.

Present Value Table.pdf Present Value Personal Finance

Appendix: Present Value Tables Figure 17.1 Present Value of $1 Figure 17.2 Present Value of Annuity Due (annuity in advance—beginning of period payments) Figure 17.3 Present Value of Ordinary Annuity (annuity in arrears—end of period payments) Previous: 17.6 End-of-Chapter Exercises

Calculating Present Value by Table Lookup

1 single cash flows. Formula: FV = (1 + k)^n Period (n) / per cent (k) 1% 1.0100 1.0201 1.0303 1.0406 1.0510 1.0615 1.0721 1.0829 1.0937 1.1046 1.1157 1.1268 1.1381 1.1495 1.1610 1.1726 1.1843 1.1961 1.2081 1.2202 1.2324 1.2447 1.2572 1.2697 1.2824 2%

Present Value Table Meaning, Important, How To Use It

A present value of 1 table states the present value discount rates that are used for various combinations of interest rates and time periods. A discount rate selected from this table is then multiplied by a cash sum to be received at a future date, to arrive at its present value.

Present Value Tables

Present Value Table The following tables will be provided in your objective test exam: Present value table Cumulative present value table Normal distribution table Open PDF Level: None Subject: None The CGMA Study Hub keeps you on track to achieve your personal study goals.

What is a Present Value Table? Definition Meaning Example

TABLE 1 Future Value of $1 FV $1 (1 + i )n n/i 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 1 1.01000 1.01500 1.02000 1.02500 1.03000 1.03500 1.04000 1.04500 1.05000 1.05500 1.06000 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1.20000

Solved TABLE B.1 Present Value of 1 Rate Perlods 1 2 3 4

Present Value Tables Formula: PV = 1 / (1 + i)n n / i 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0..